When I conduct research, I often like to have conversations with participants about hopes and fears. Lately, we’re talking a lot more about fears than hopes.

Risk— and its mitigation— has always been at the heart of marketing. Think about why marketers issue coupons or take temporary price reductions. It’s partly to reduce the perceived risk of trying a product or service. Why do brands put testimonials in their consumer communications? Or work so hard to get good online reviews? Because this information reduces perceived risk. The list goes on and on. Nearly every marketing tactic is aimed, at least in part, at risk. Think about, on the most fundamental level, what a brand actually is. I’ve always subscribed to the philosophy that a brand is a promise—a reason to believe that the user or consumer experience will be a positive one. So, the very process of establishing and maintaining a brand is a perceived risk reduction strategy.

And that’s why risk has always been one of the fundamental things we study in market research. So much of the research I’ve done over the course of my career has been about either understanding risk, or about evaluating the effectiveness of marketing strategies and tactics at addressing specific risks.

This is a particularly important issue now; we’re all living in a world fraught with risk. I have friends and colleagues who have felt unable to leave their homes since March because they see the dangers as being too great. As a researcher, I’ve interviewed a lot people who suffer from chronic diseases over the past few months. The Pandemic-That-Shall-Not-Be-Named has dramatically altered their relationship to their health conditions. Because they see their condition as being a risk factor if they become infected with you-know-what, they report having become more compliant with respect to taking medications, and state that they are being more diligent at adopting a healthier lifestyle.

When it comes to the actual practice of research, risk has become a particularly resonant issue. Like my colleagues and clients, I’m eager to get back to conducting in-person qualitative. But it’s hard to know when the benefits of doing so will outweigh the dangers. And, regardless of how my clients and I feel, will research respondents be willing to participate face to face?

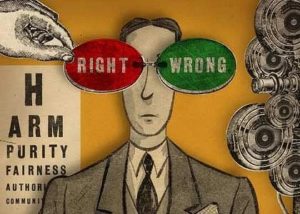

Because we are more conscious of risk in our personal and professional lives, it’s valuable to be able to think and talk about risk in a clear, organized and detailed manner. Which means that it’s helpful to have some frameworks to think about risk. One of the most useful tools I employ when trying to understand risk is my Perceived Risk Model, which I developed several years ago. It’s a good way to understand specifically how individuals see the risks they face. The model breaks perceived risk down into six specific types: physical, resource/asset, functional, psychological/self-image, emotional and social.

I’ve found that these perceived risk types are characterized by questions people ask themselves when evaluating risk. By watching out for questions like these when talking with research participants, we can get a sense as to the specifics of how they perceive risk.

Physical — “Could this be harmful? Could it injure me or make me ill? Could it endanger others?”

Resource/Asset — “Do I have time for this? What else could I do with the time or money this will require? Can I afford this? What could be the financial effects of an adverse outcome?”

Functional — “Will this perform as expected and required? Will it do what I need it to do? What are the chances of it failing to function as needed? What are the possible ramifications if it doesn’t perform well?”

Psychological/Self Image —“Am I doing the right thing? What does this say about me as a person? Will this decision affect how I view myself?”

Emotional — “Could this cause sadness or disappointment? Do I have the emotional reserves to handle this if it works out badly?”

Social — “How will this affect how others see me? What will this do to my standing within the groups and organizations with which I am associated?”

Here’s an example of how examining risk can lead to important marketing insights. A few years ago I was conducting research on a dietary supplement for individuals with a rare metabolic condition. Patients had, for years, resisted using the supplement, despite strong evidence that it would noticeably improve their health. The client had long believed that the primary concerns for users were linked to functional risk and resource risk, and so they had built their communications to patients and the registered dietitians who treated them around mitigating these risks. They provided data that the product would positively affect patient health, and was well worth the high cost because it could help patients avoid even more costly problems associated with the condition. However, these tactics were largely ineffective. Conversation with patients and dietitians about perceived risks revealed that the single biggest barrier to usage was actually social risk. It turned out that diet supplementation was perceived by influencers within the condition community as being either ‘unnatural’ or a sign of weakness. Once the client started orienting brand communication around this perceived risk, the business began trending upward.

So, once it becomes clear that risk is playing an important role in consumer decision making or behavior, use this Perceived Risk Model to understand that risk on a more granular level. This is just one analytical tool for understanding risk. I have quite a few more risk tools in my toolbag, and I’ll be devoting a number of future newsletters to them, so stay tuned.